December 17, 2008

December 16, 2008

Tree of Life : Klimt

r

The Tree of Life

Artist Gustav Klimt (1862-1918) was a forerunner of Modernism and the Art Deco movements, helping to pioneer the Viennese Secession and Art Nouveau movements.

December 15, 2008

Bob Franken: Modern-Day Pyramids and Ponzi Schemes :Huffington Post

Image via Wikipedia

"As we're discovering, almost the entire economy is the moral equivalent of a Ponzi scheme." Think about it. Our currency is base on Trust. People trusted Madoff but when he had to payoff, it became clear he really Mad(e)off with their money.

Interestingly similar, people trust the United States with their tax money and the printing of currency. With the creation of 7 to 8 trillion in new money are we approaching a "Madoff" point where the trust just isn't there?

When so many of our citizens and institutions are expecting a payoff (bail-out) from the government . . .we move further away from the democratic experiment the founders of our American democracy envisioned. A democracy for moral, responsible people. A people whose payoff comes through moral living, creative enterprise, and respect of each other as one family under the creator from whom life, liberty and this pursuit of happiness are freely bestowed.

I'm a conservative and yet I'm glad Obama is president. He is the only one with enough charisma to move forward . . . as long as the grime sooooooo near him . . . doesn't tarnish his image is the eyes of the people. On this point I'll bet even the Democrats are learning to pray. ME?! I'm already praying and working on plan B.

I don't really understand why we're paying so much attention to Bernard Madoff.

Oh sure sure, if the charges are accurate, the collapse of his Ponzi scheme might just put him in the Fraud Hall of Fame.

But he'll have plenty of company. In the world of finance, however, it's probably more accurate to say he will achieve new heights in the realm of illegal fraud.

As we're discovering, almost the entire economy is the moral equivalent of a Ponzi scheme.

Hyperbole? Well, let's see:

While the operating details may be different... somewhat anyway...it's undeniable that much of our financial and industrial structure is a Pyramid based on a phantom foundation.

It has been constructed by opportunists who were such con artists they didn't care whether it ultimately imploded, as long as they got theirs.

Or so inept they had no business around the building.

Or worst, the people who adopted the "Get along-go along" approach to success...never going against the grain, no matter what.

Those may be the most corrupt of all, since their expedient "make no waves" mentality was at the very least amoral, which is another way of saying immoral.

By the way, that would include the politicians who looked the other way so they could either get the crumbs in the form of campaign contributions, or because raising a stink was simply too much of a hassle.

Now that the chickens have come home to roost the home has caved in.

There are important differences between Madoff and the others:

First of all, he has not had the chutzpah to ask for a multi billion dollar loan to bail him out. At least so far.

Secondly, a sizable chunk of those who have been harmed by his enterprise are the prosperous, or soon-to-be former prosperous.

The rest of the financial schemes have damaged or destroyed the well-being of nearly everyone..rich, poor and somewhere in between, including those who believe that Ponzi was a character on "Happy Days"

During these UNhappy days, as we clean up this mess, we need to go beyond oversight regulation. It is essential that we write into the law prohibitions that drag a lot of these shady dealings and their dealers across that narrow line that separates barely legal and illegal.

In other words we need to call all this larcenous conduct what it is: A crime.

Bob Franken: Modern-Day Pyramids

Related articles by Zemanta

- The $50-billion BMIS debacle: How a Ponzi scheme works

- The real Ponzi behind the 'scheme'

- Bernard Madoff: What is a Ponzi scheme and how does it work?

- The 10 Nastiest Ponzi Schemes Ever

- Revealed: desperate final hours of the world's biggest ever financial fraud

- Money Invested with Madoff in "Money Heaven"

- SEC failed to inspect Bernard Madoff fund

- Banks face huge losses from $50B 'scam'

- Bernie Madoff's Ponzi Victims Include Mort Zuckerman

Guard yourself against identity theft on social networks | Dallas Morning News | Pamela Yip

Image via CrunchBase, source unknown

Yes, we have freedom in America. But . . .

Guard yourself against identity theft on social networks

08:14 AM CST on Monday, December 8, 2008

By PAMELA YIP / The Dallas Morning News

pyip@dallasnews.comThe next source of identity theft may be social networking Web sites.

And social networking sites such as MySpace and Facebook are becoming a "growing pool of valuable information that at some point thieves may consider more valuable than a credit report," Mr. Mitic said.

For example, most of us use facts associated with our lives as user words or passwords, and thieves are learning they can mine these facts from social networking sites.

"I know most Americans who, if they have pets, that's usually their password," Mr. Mitic said. "The information that may seem innocuous to share may have real value to individuals with criminal minds."

Social networking sites enable people to freely express themselves in a way that may cause them to unwittingly drop morsels of information that criminals can extract to steal their identity.

Here's how it might work:

Your profile says that you live in Texas, you were born in Dallas, your beloved pet's name is Max and that you like to spend time with your parents, Dick and Jane.

It also says that today you're venting your anger at your bank – Bank XYZ – because it's been slow to resolve a problem with your account.

Now criminals know the name of your bank, the name of your pet and your mother's name. They will seek to learn your mother's maiden name, which is often used as a security question on bank Web sites.

Related articles by Zemanta

- Are You A Safe Surfer? Protect Your Identity!

- Video: Protect Yourself Against Identity Theft

- The Facebook Virus Spreads: No Social Network is Safe

- Identity thieves cashing in on Canadians' info online, police warn

- Social networking maybes

- DIY ID Theft Protection [Identity Theft]

- How to handle ID fraud's youngest victims

- Thieves stealing children's identities

- Identity theft warning to web networkers

- Is Social Network Identity Theft A Crime? No, A Pain in the Arse

1971 December 15th

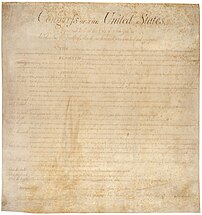

Image via Wikipedia

Lest we forget. These documents show the founders of America understood that the creator and the people, not the government, is the source of the power for life, liberty and the pursuit of happiness.

- Bill of Rights: Amendments I-X of the US Constitution, granting substantial individual liberties, became law (1791)

Related articles by Zemanta

December 14, 2008

World Vision - Microenterprise Development Program: How Microloan Works

Much thanks to Ant_L.Xanga.com for this insight.

Microenterprise Development Program: How Microloan Works

![]()

1. The entrepreneurial poor apply for loans:

A traditional bank loan is unattainable for most of the world’s poor. They have no credit, they may own no property, and if they have a business, it’s likely struggling despite long hours of hard work. Through a variety of strategies like group lending through community banks, and cross-guarantees, loans can effectively and efficiently be provided to people who lack collateral but who demonstrate an entrepreneurial spirit, trustworthiness, a good work ethic, and sound business ideas. The proof it works: 96% of loans are repaid on time!

(Back to top)

2. World Vision disburses microloans:

Loan sizes vary from $50 to $5,000, most typically in the $100 to $2,000 range. Usually loans are given to groups of five to 30 microbusiness operators who band together for self-administration, mutual encouragement, and accountability. This ensures that even the poorest of the poor can have access to credit because these entrepreneurs cross-guarantee each other’s loans and support each other’s businesses. Most World Vision loan recipients are women, who consistently use their extra income to benefit their children.

(Back to top)

3. Credit officers coach loan recipients:

Credit officers begin coaching clients before they receive their first loan, and continue with regular follow-up throughout the term of the loan. Business coaching includes assistance with accounting, marketing, and managing—all based on biblical and ethical business principles.

(Back to top)

4. Growing businesses thrive:

With a loan, entrepreneurs start carpentry shops, improve farming, operate flower businesses, purchase livestock, run food services, and weaving businesses, to name a few. These businesses create jobs and generate additional goods and services, thereby enhancing the entire community. Last year, over 185,000 jobs were created or sustained through our clients’ business successes.

(Back to top)

5. Loans are repaid:

The poor are a good credit risk, repaying their loans more than 96 percent of the time. As loans are repaid, borrowers become eligible for larger loans. The reasonable interest rate sustains the loan program, while maintaining low arrears and efficient operations.

(Back to top)

6. Families gain self-sufficiency:

Families who receive small loans report better family health, an increase in their business earnings, and the ability to spend more on food, medicine, and education. According to a study by George Washington University of microloan recipients in World Vision projects:

- More than 90 percent reported improved business skills.

- 75 percent reported an increased sense of empowerment.

- 80 percent reported improved family health in East Africa.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=f786b5a4-5faf-4300-b945-9fd848588491)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=7957873a-0c20-4f9b-881a-6eaa0fe68adc)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=52f63f95-7184-4411-8bb2-11925c6324f0)